DeFi. Simplified.

Maximize Your Yield with Matrix Farm: From Uniswap V2 Vaults to Unique Liquidity Strategies

With the lowest performance fees on the market.

Unlock the Full Potential of DeFi

Effortlessly access a diverse range of DeFi protocols and strategies.

Smart Rebalancing

Automatically rebalances assets in concentrated liquidity pools to optimize yields.

Multichain Support

Manage your assets effortlessly across multiple chains, with aggregated insights in one unified view.

Auto-Compounding

Automatically reinvests rewards to maximize your asset yield.

Optimized Zap

You can deposit either the chain's native currency or strategy tokens directly into the vault without creating the LP.

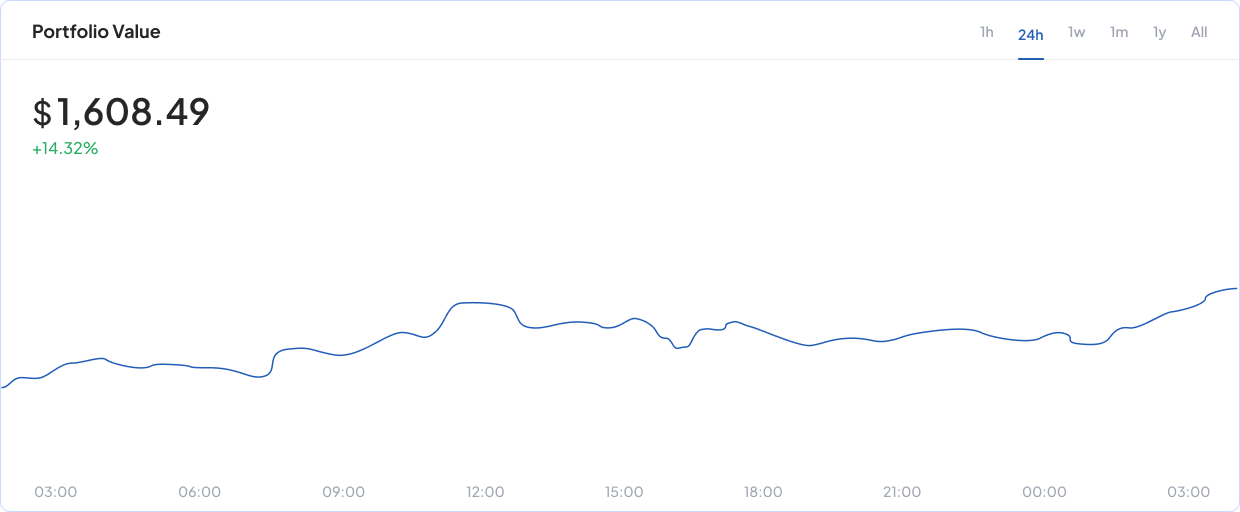

Historical portfolio performance

Gain insights into the historical performance of your portfolio

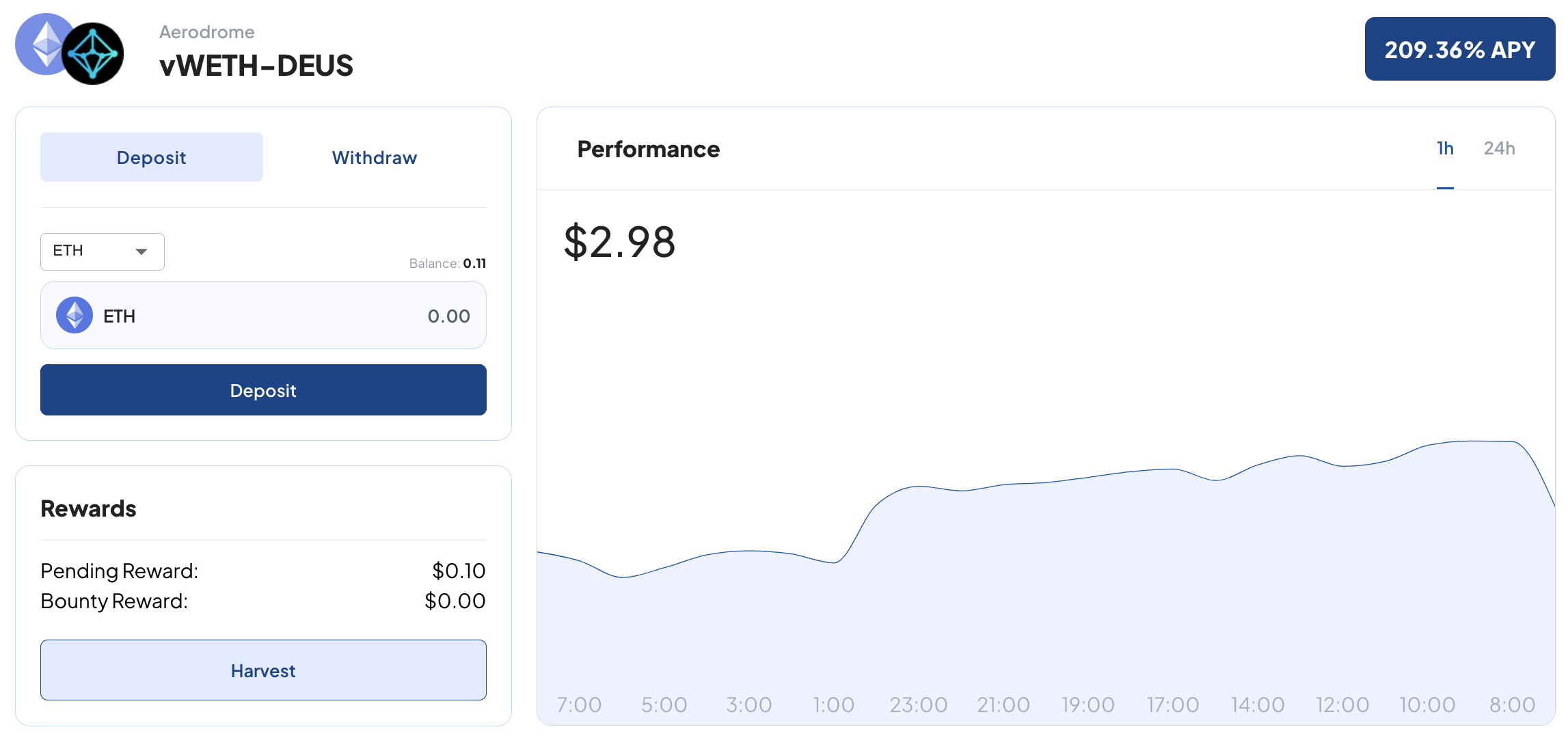

Historical strategy performance

We also provide you with data for all the strategies you've used, so you can identify your best and worst performers.

The benefits

Fast

Stop switching between aggregators, DEXes, and farms. With Matrix, you can dive directly into a strategy using the native currency.

Optimized Autocompounding

We share a portion of our fee with those who call the autocompound function. This ensures, through a network of bots and third parties, that we aren't the sole point of failure for the platform's operation. It also guarantees optimized compounding times based on the rewards pending in the strategy.

Lowest Fees

We charge a 4.5% performance fee and share a portion with the community, while other autocompounders charge 9-10%.